Introduction

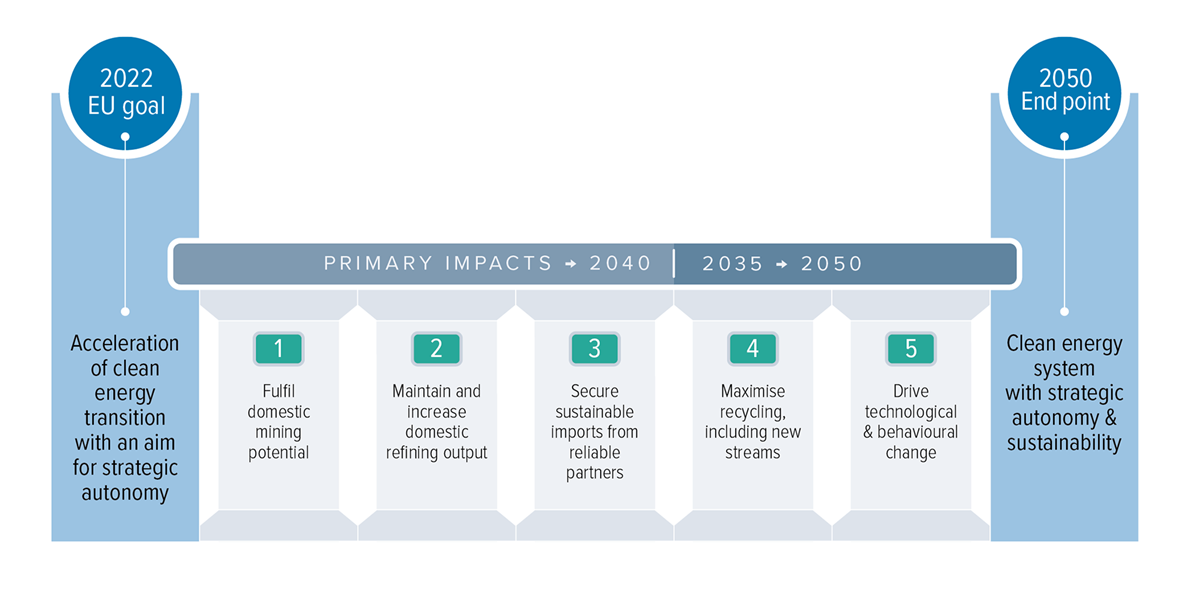

Metals will play a central role in successfully building Europe’s clean technology value chains and meeting the EU’s 2050 climate-neutrality goal. In the wake of supply disruptions from the COVID-19 pandemic and Russia’s conflict in Ukraine, Europe’s lack of resilience for its growing metals needs has become a strategic concern.

This study evaluates how Europe can fulfil its goal of “achieving resource security” and “reducing strategic dependencies” for its energy transition metals, through a demand, supply, and sustainability assessment of the Green Deal and its resource needs.

It concludes that Europe has a window of opportunity to lay the foundation for a higher level of strategic autonomy and sustainability for its strategic metals through optimised recycling, domestic value chain investment, and more active global sourcing. But firm action is needed soon to avoid bottlenecks for several materials that risk being in global short supply at the end of this decade.

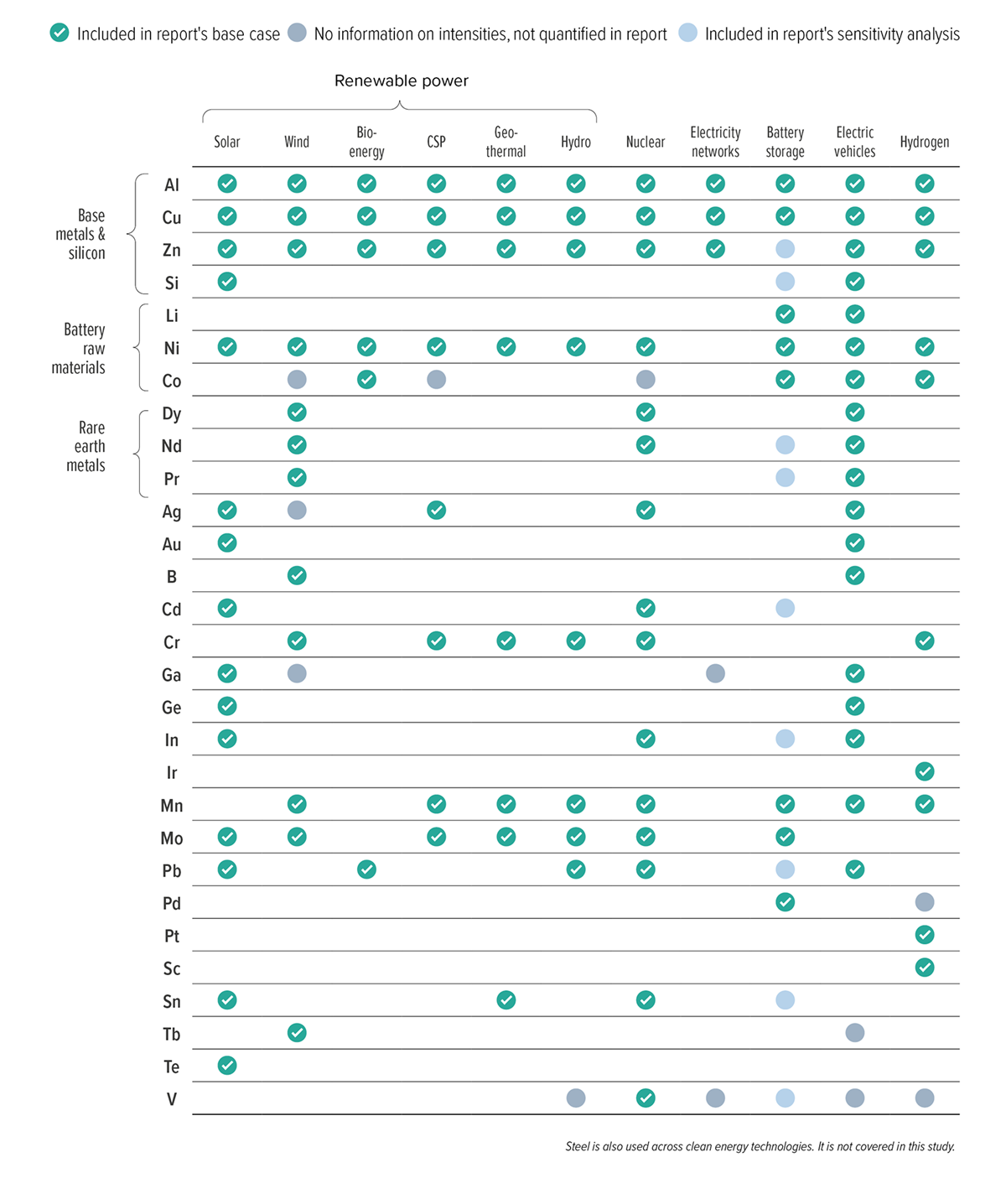

The metals intensity of the energy transition

Europe is planning a rapid shift away from today’s fossil fuels system towards clean energy technologies.

Europe is planning a rapid shift away from today’s fossil fuels system towards clean energy technologies. This energy transition is metals intensive. Electric vehicles, batteries, solar photovoltaic systems, wind turbines, and hydrogen technologies all require significantly more metals than their conventional alternatives to replace fossil fuel needs.

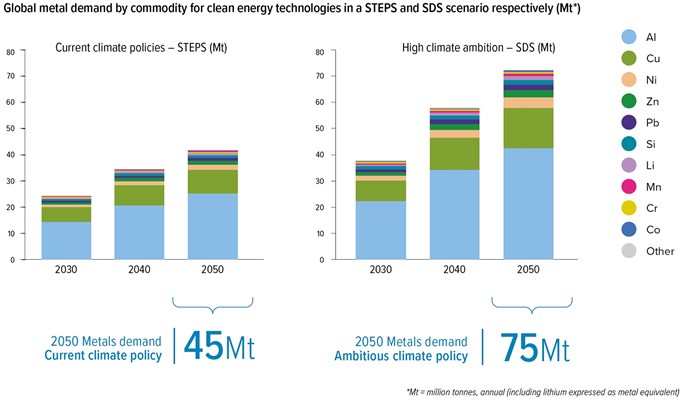

According to the International Energy Agency’s different clean energy technology scenarios, a world climate trajectory aligned with the Paris Agreement will require almost twice the volume of metals by 2050 as a world continuing with its current climate policies (for context, ~80 Mt of required new metals supply compares with today’s 1,855 Mt annual global steel consumption and 8,561 Mt coal).

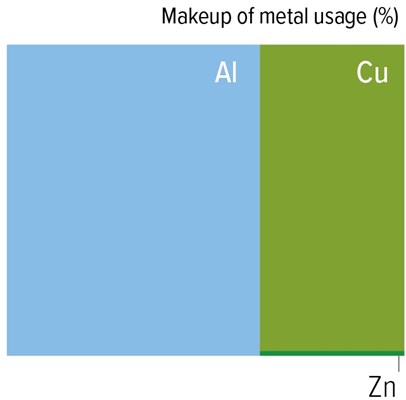

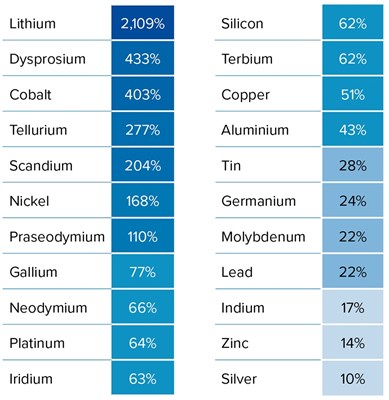

High volume base metals like aluminium and copper dominate in terms of their tonnage used in clean technologies, but several lower volume metals such as lithium, cobalt, and dysprosium will have an extremely high demand pull from the transition.

SDS (Sustainable Development Scenario)

The demonstration of a plausible path to concurrently achieve universal energy access (affordable, reliable, sustainable, modern), set a path towards meeting the objectives of the Paris Agreement on climate change and significantly reduce air pollution.

STEPS (Stated Policies Scenario)

A benchmark to assess the potential achievements (and limitations) of recent developments in energy and climate policy. Based on a sector-by-sector assessment of the specific policies that are in place, as well as those that have been announced.

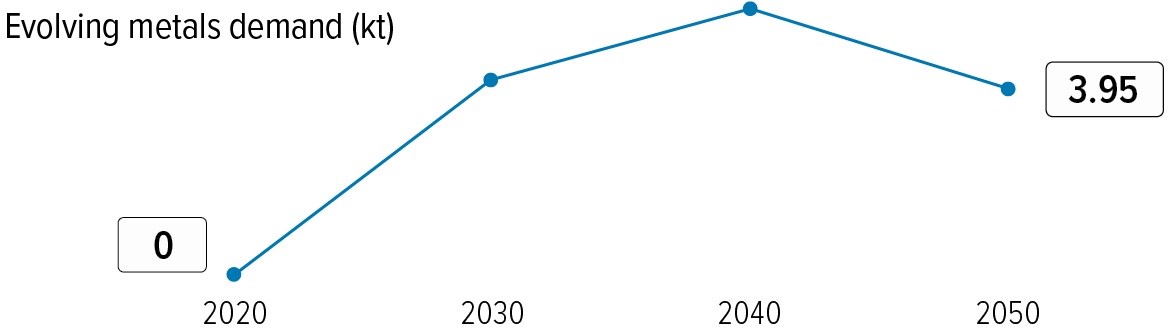

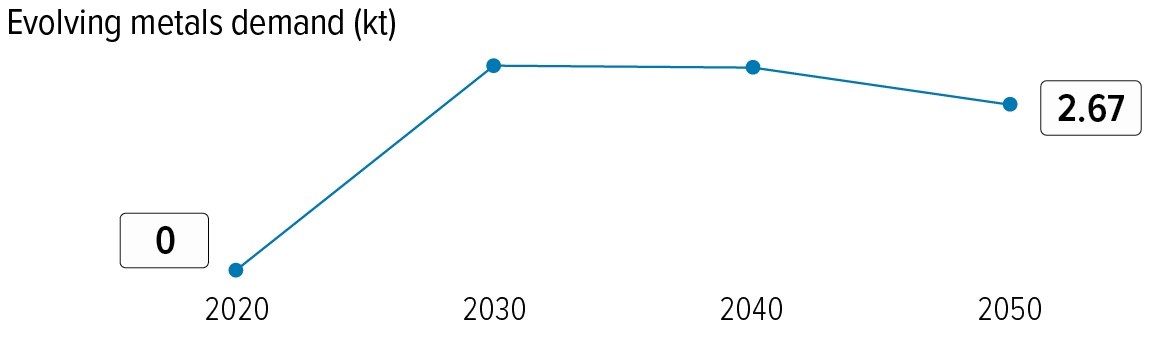

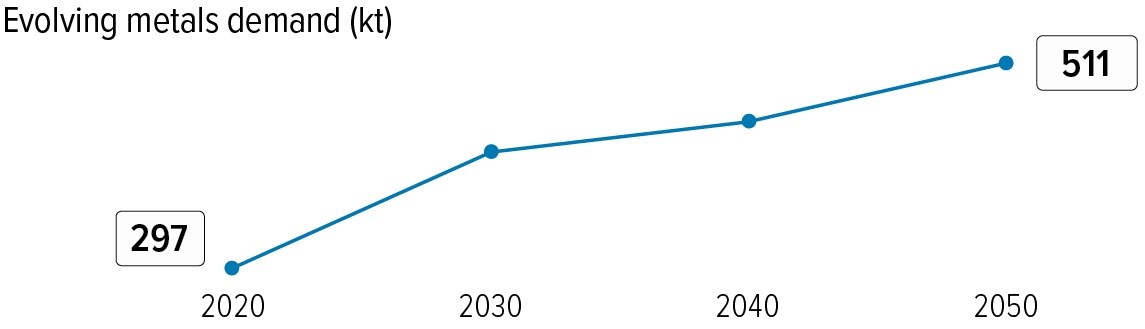

Evolution of European metals demand per clean energy technology

Europe’s planned production of clean energy technologies requires a secure metals supply

Europe’s 2050 climate-neutrality goal and 2030 mid-term target means it is already accelerating at a faster pace than other world regions, with plans to install most of its new clean energy technology capacity in the next 1-2 decades. Europe will only require a direct metals supply for the technologies it produces domestically (vs. imported products).

Europe and its industries have public plans to grow or establish domestic production of each clean energy technology, at different maturity levels. This study quantifies the metals requirements if all those plans are successful.

ELECTRIC VEHICLES

The European automotive industry is a mature net export market. As electrical vehicles will replace traditional ICE cars, it is assumed that Europe retains its current market position.

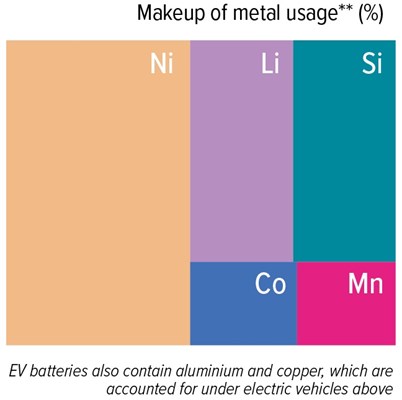

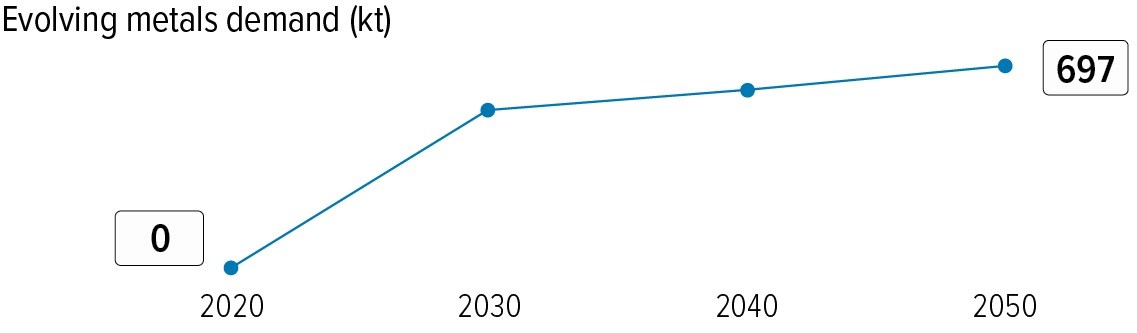

EV BATTERIES

Europe has a current project pipeline for 540 GWh of lithium-ion battery capacity per year, equivalent to 5-9 million vehicles. Cathode and anode production capacity – the value chain stage require metals input – is also ramping up, though at a slower pace.

SOLAR PV

The 2021 European Solar Initiative aims at restoring and rescaling the solar PV value chain in Europe after its loss to China, with an initial objective of 20 GW production by 2025.

WIND TURBINES

Europe is a significant producer of wind turbines and a net exporter of components, with a current capacity of 15 GW per year. There are ambitions to grow this capacity to meet the demands of the next decade, but without formal targets.

HYDROGEN

The European Clean Hydrogen Alliance plans that Europe takes a leading role in the R&D and production of hydrogen technologies, and there is potential for a considerable share to be produced domestically.

PERMANENT MAGNETS

The European Raw Materials Alliance has finalised a pipeline for creating a domestic value chain to supply 20% of Europe’s permanent magnets needs by 2030, reducing dependence on China.

ELECTRICITY NETWORKS

The European Clean Hydrogen Alliance plans that Europe takes a leading role in the R&D and production of hydrogen technologies, and there is potential for a considerable share to be produced domestically.

Europe's metals needs until 2050

Europe’s energy transition will be the major growth driver for key metals markets

Europe’s plans to establish domestic production for clean energy technologies will increase its demand for a wide range of metals. Three groups are focussed on in detail.

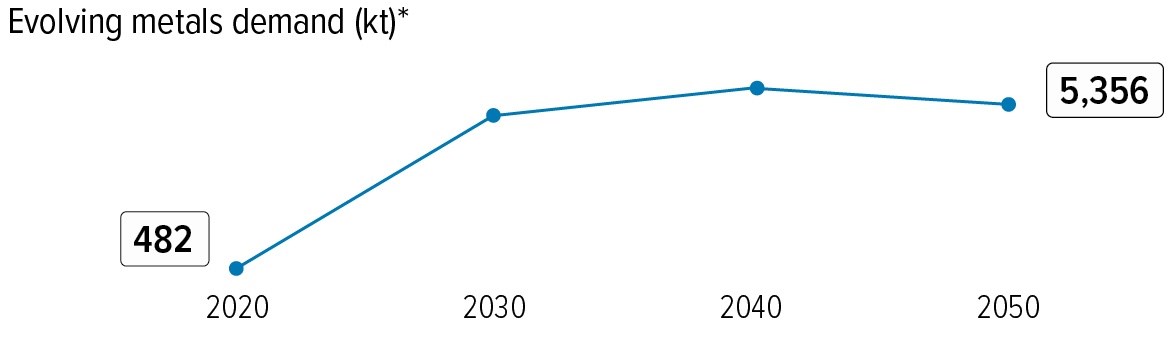

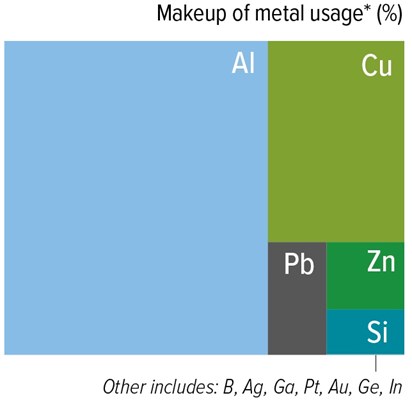

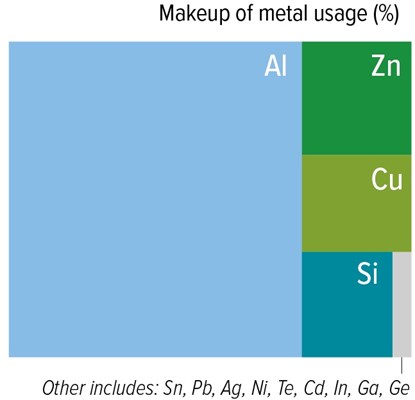

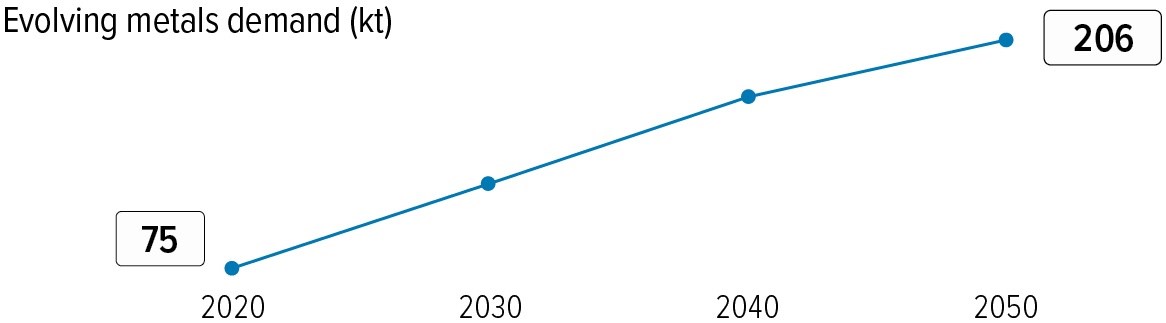

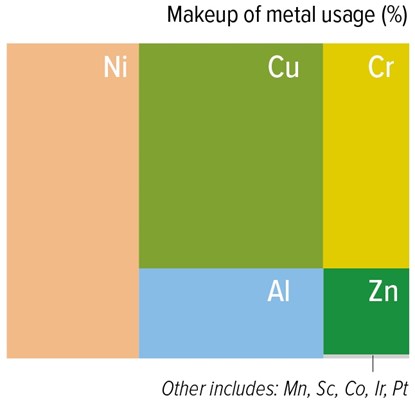

BASE METALS AND SILICON

Europe’s energy transition will be the major new growth driver in most base metals and silicon markets, which already include widespread uses.

Aluminium and copper have widespread energy transition uses (plus other energy-saving uses in buildings). By 2050, Europe will require new demand equivalent to 30-35% of today’s consumption levels for manufacturing of electric vehicles, electricity net- works, batteries, wind turbines, and solar panels.

Silicon's new demand of up to 50% of today’s use levels will be required if Europe succeeds in reshoring a level of solar photovoltaics production and establishing battery anodes production (with silicon projected to have a growing use alongside graphite).

Zinc has several energy transition uses, but not in high enough volumes to meaningfully impact today’s consumption levels.

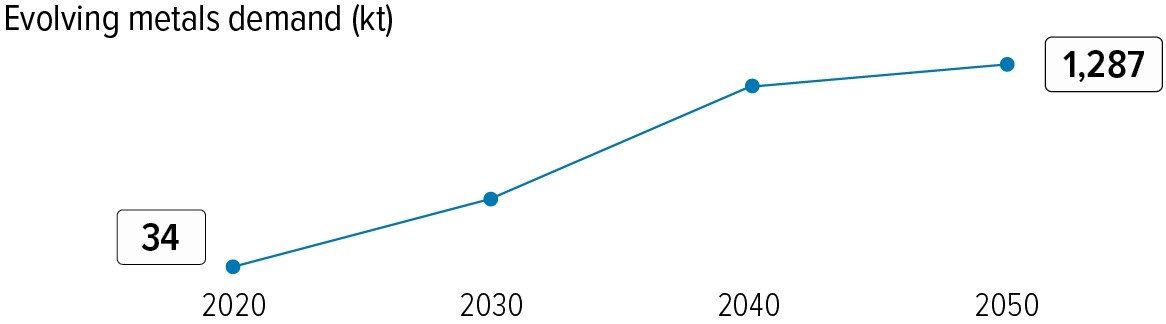

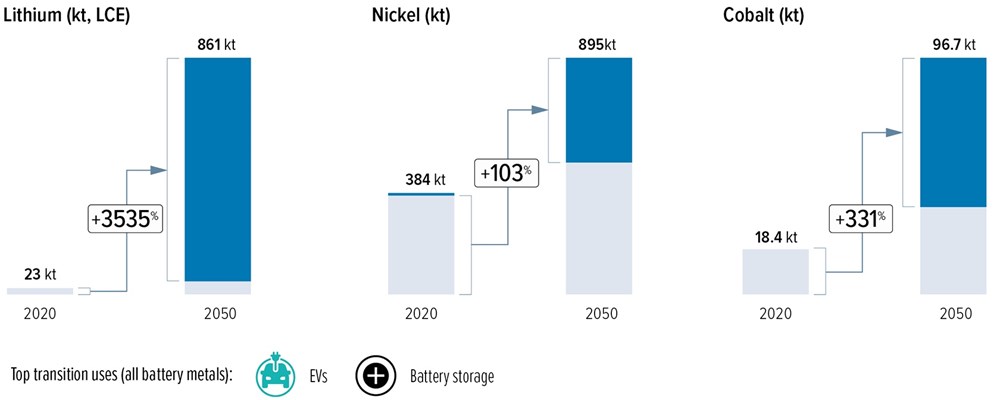

BATTERY METALS

Europe will require significant new supplies of nickel, lithium, and cobalt for its domestic battery cathode manufacturing plans. Of these metals, Europe only has a significant existing market for nickel, which is mainly used in stainless steel.

By 2050, batteries will be Europe’s major use for lithium, nickel, and cobalt under all the study’s scenarios, with new demand reaching up to 3500% of Europe’s lithium consumption today, 350% of cobalt, and 110% of nickel.

It is noted that uncertain technology developments after 2030 will likely impact these long-term projections, and so regular attention will be required to the battery market.

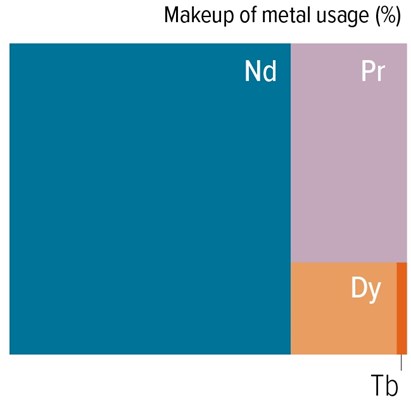

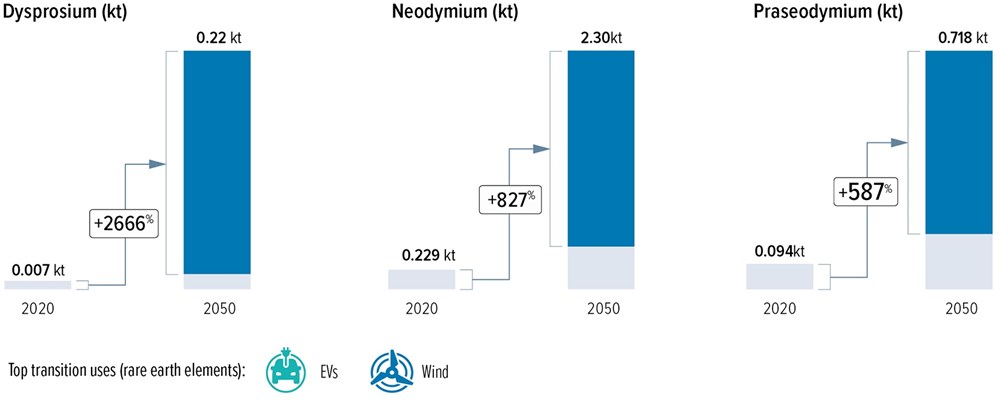

RARE EARTH METALS

Significant volumes of rare earths in permanent magnets will be required in Europe’s electric vehicles and wind turbines.

But Europe will only require new supplies of rare earth metals if it is successful in building up domestic permanent magnets production - competing against China's near monopoly of the rare earths/permanent magnets market.

Even a moderate level of European domestic magnets production - as reflected in the study's medium scenario - would transform the European rare earths market, requiring between 90% and 200% extra compared with Europe's consumption today.

OTHER metals

The energy transition will also significantly impact on several minor metals. Iridium, scandium (hydrogen), and tellurium (solar PV) will have >50% of their 2030 demand from clean energy technologies and major supply pressures. Gallium, germanium, indium and tin are projected to have high combined growth from solar PV and digital applications.

How Europe can supply its growing metals demand

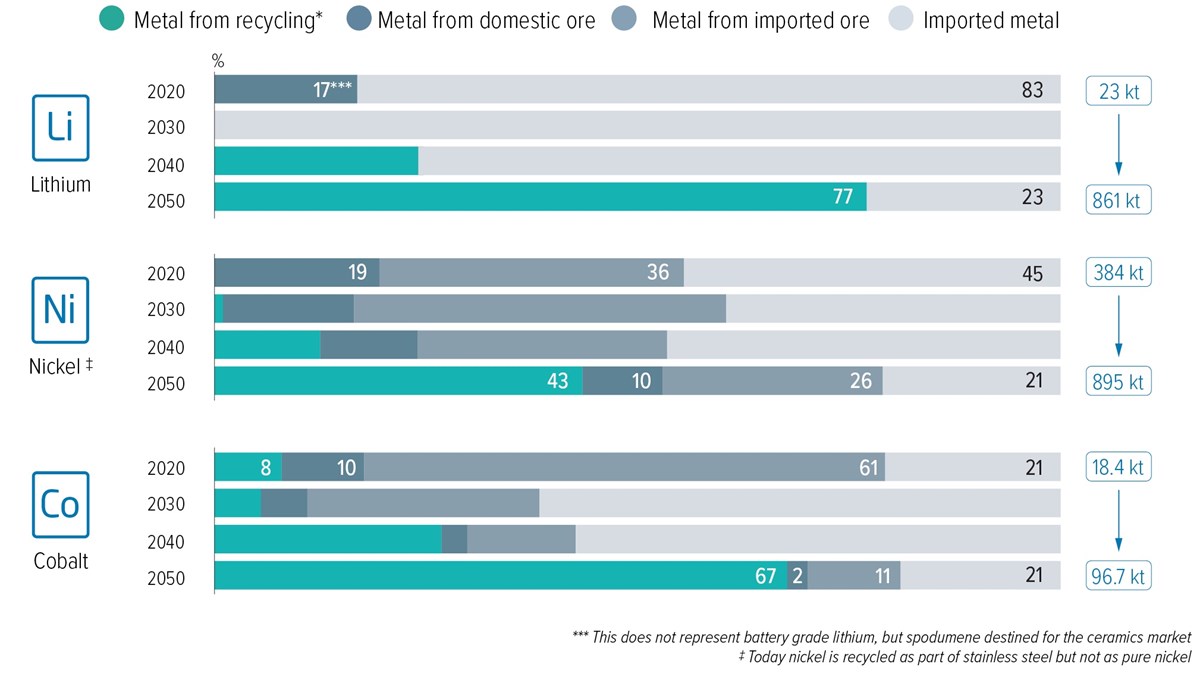

Europe will need to combine long-term recycling growth with new primary metals supply

Europe needs to make strategic choices on how it will supply its accelerating metals demand.

For the next 15 years, Europe’s energy transition will predominantly require new primary metals supply from mining and refining. These needs can be supplied through a combination of domestic production capacity and imports (either of mined ores or manufactured metals and chemicals).

Secondary supply from recycled sources will take a more prominent role as today’s clean energy technologies begin reaching their end-of-life. After 2040, recycling could be Europe’s major supply source for most transition metals, alongside the continued need for primary metal. This requires major efforts to build new recycling capacity and overcome bottlenecks.

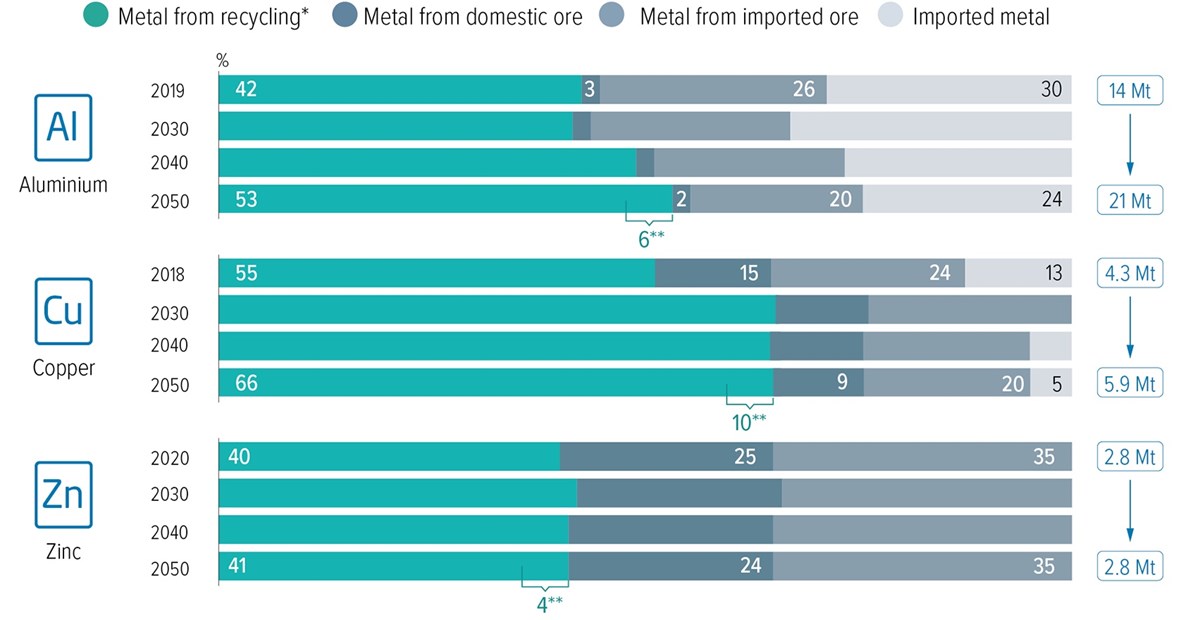

EUROPE's RECYCLING POTENTIAL

BASE METALS

Recycling already provides between 40% and 55% of Europe’s aluminium, copper, and zinc supply. More metal in stock will become available to recycle by 2050, but future growth will also require improvements to collection and sorting operations, and the prevention of scrap leakage.

SILICON

Europe will need to develop a new recycling industry for solar PV panels, which will start reaching end-of-life in meaningful volumes after 2035. Pilot plants are currently being set-up.

BATTERY METALS

Europe will need to develop new recycling capacity for Electric Vehicle batteries. The first generation will start reaching end-of-life in significant volumes after 2035. By 2050, recycling can give Europe a major supply source if batteries reach EU recyclers and new recovery technologies are commercialised.

RARE EARTH METALS

Europe will need to develop new recycling capacity for permanent magnets and overcome economic challenges. Because Europe only aims to produce part of its permanent magnet needs domestically, the volumes of rare earths available from magnet recycling could exceed Europe’s needs after 2040.

RECYCLING LIMITS

The contribution of recycling to Europe’s metals supply is limited by the amount of metal that will be available in its scrap, as well as the effectiveness of the recycling system. Metals have a long average lifetime in the economy (e.g. 30 years for copper), and given historical growth rates there remains a gap between available secondary material and demand.

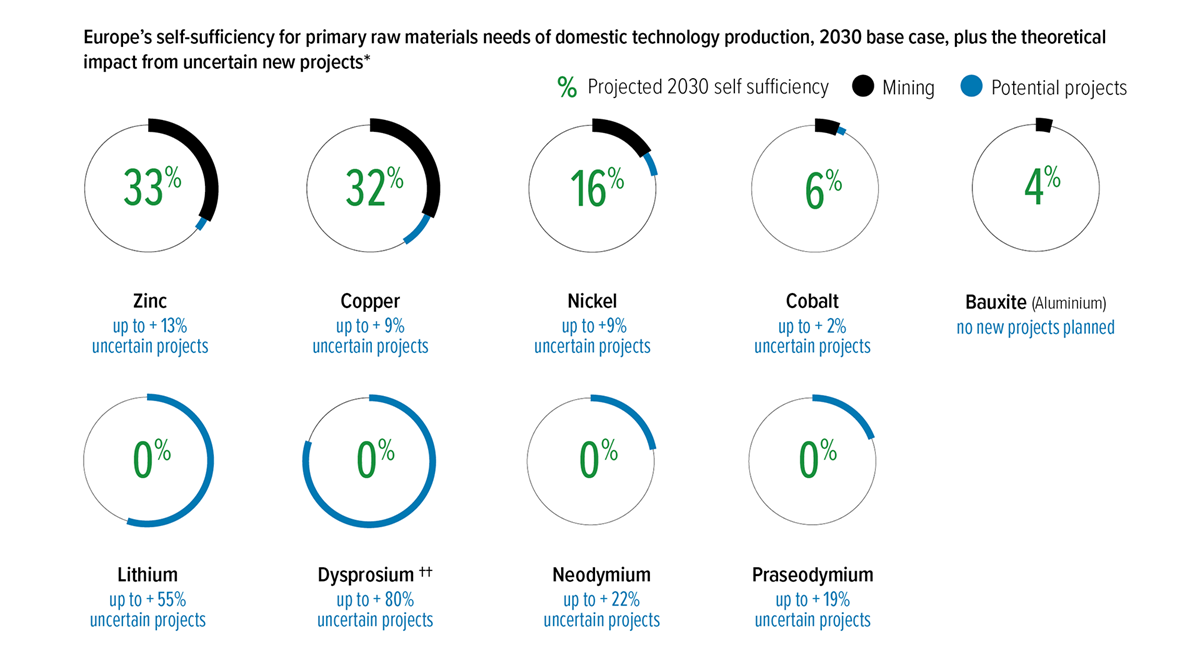

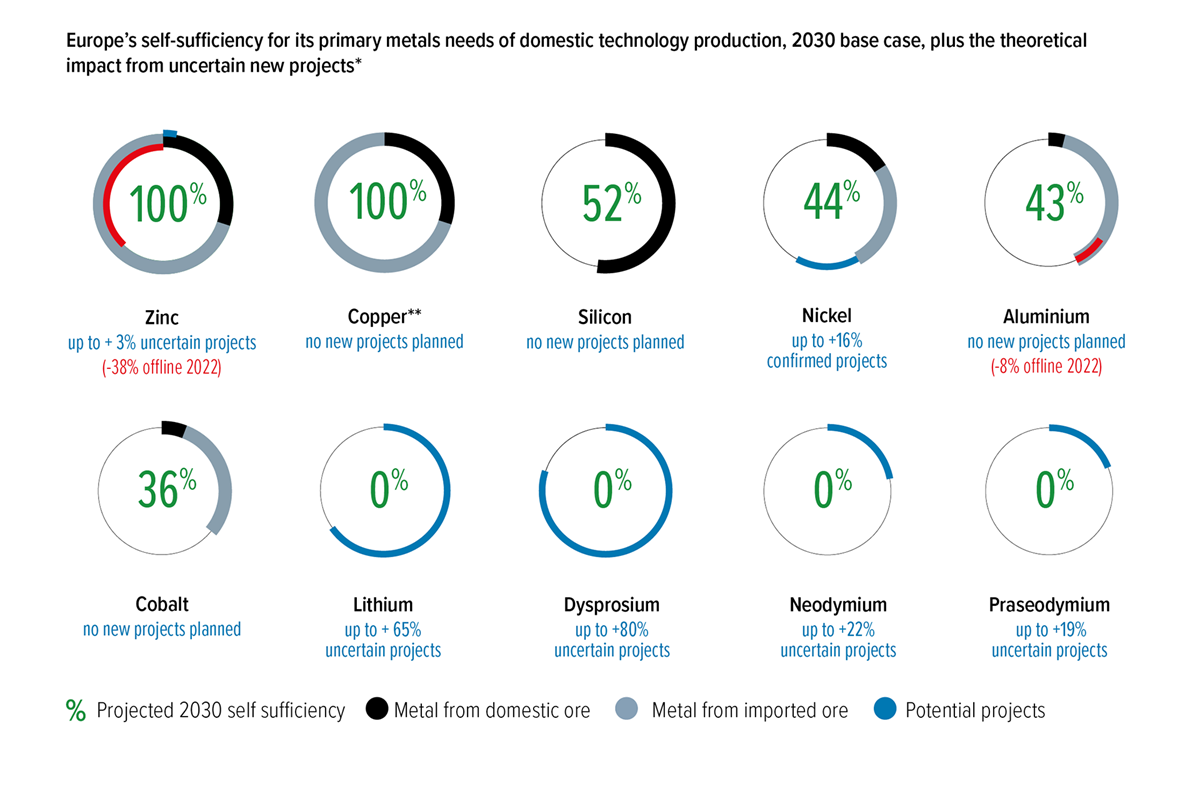

How much metal could Europe mine and refine domestically?

Europe’s raw material strategy aims to improve its metals mining and refining self-sufficiency. Firm short-term action would be needed to take potential projects forward ready for softening the impacts of 2030’s accelerated demand. Global mining and refining capacity additions are today mainly happening outside of Europe.

MINING

- Potential: Europe has a large but uncertain mining project pipeline for lithium and rare earths. For copper, zinc, and nickel, potential projects would mainly compensate for depletion of existing mines instead of major new growth. There are no plans to mine more bauxite domestically, and cobalt mining capacity is minor compared with demand.

- Challenges: Most planned new mines in Europe have an uncertain future due to lack of local acceptance, technical uncertainties, or permitting challenges.

If no new mines are opened there will be a further depletion of Europe’s mining capacity, by 50% for copper and zinc in the next 20 years.

REFINING

- Potential: New European lithium and nickel refinery plans have been announced in the last year. Further refining announcements will be necessary for Europe to get an equivalent self-sufficiency as for its mature base metals markets.

- Challenges: Europe faces a legitimate risk of further metals production leakage without framework conditions like affordable clean energy supply and fair trade conditions.

High European power prices had in early 2022 resulted in 35-45% of the EU’s aluminium, zinc, and silicon capacity being taken temporarily offline, risking permanent smelter closures.

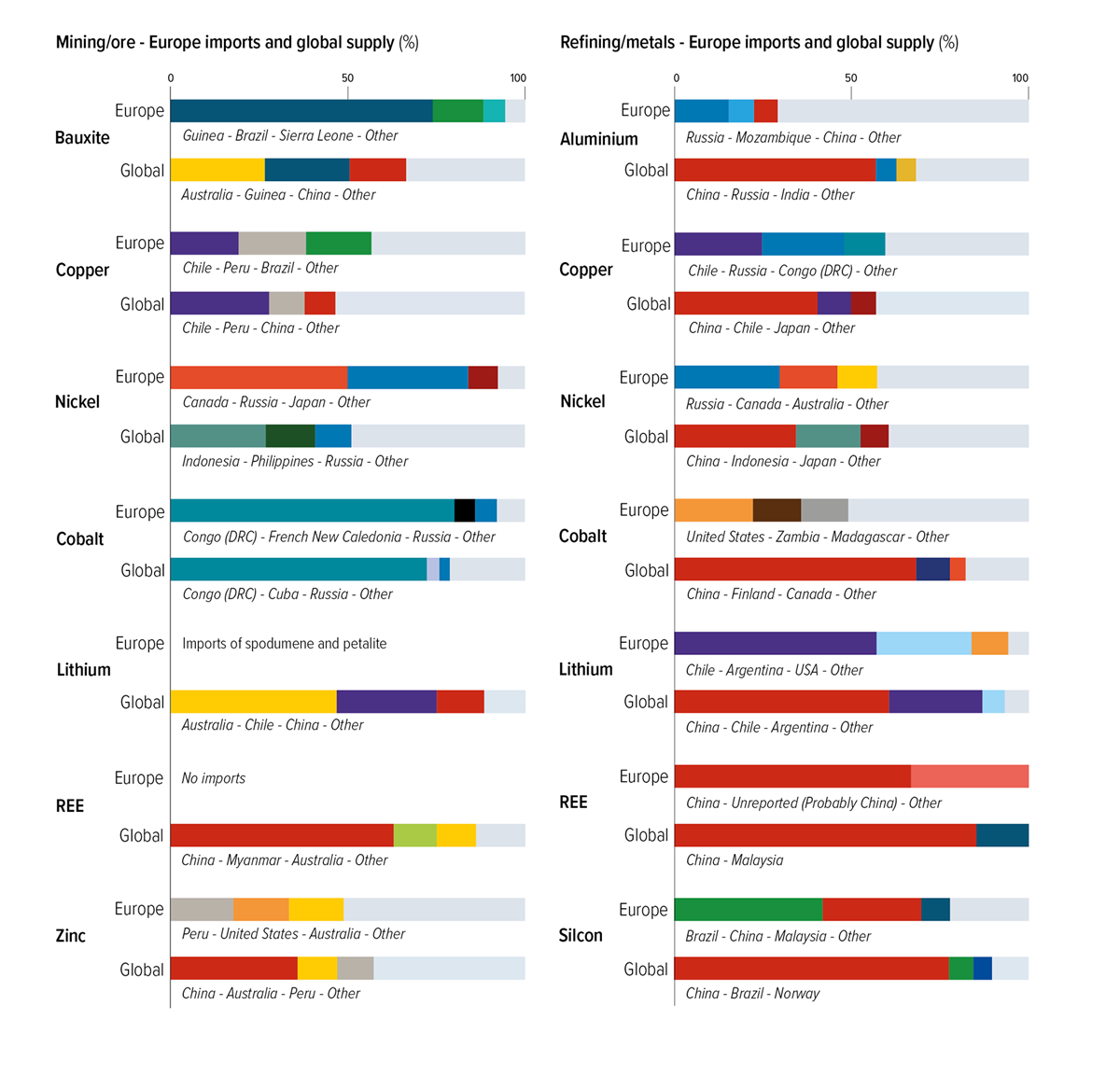

Europe's reliance on global markets

Risks of supply constraints

Europe will need to import more lithium, cobalt, rare earths, and nickel to supply its energy transition, up to a peak in 2040. If new refineries are opened in Europe, then metal ores will be imported in higher volumes instead of the metals. Opening new mines in Europe will soften demand for imported ores but not replace the demand.

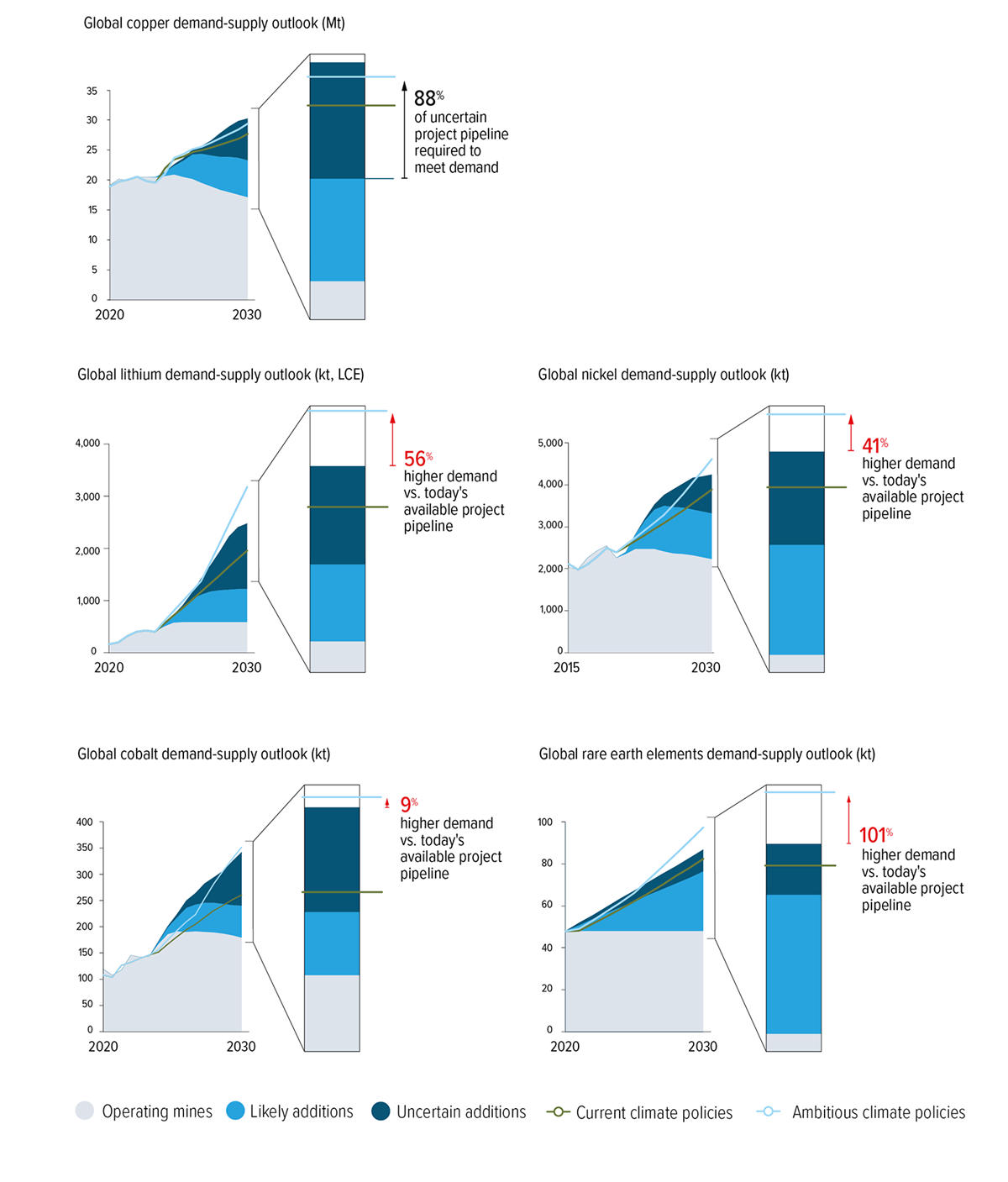

Global metals markets are at risk of supply constraints in this period without an acceleration in mining supply. The rapid global deployment of electric vehicles and renewable energy would result in a disruptive demand pull for five metals - copper, lithium, nickel, cobalt, and rare earths metals – that will be difficult to meet even if all the currently available project pipeline gets brought online.

Other markets have different challenges, including pressure on the global silicon and aluminium markets from China over capacities, and uncertainty of where new aluminium smelting capacity will be installed given its need for low-cost and ideally low-carbon power sources.

If European industries have not secured long-term domestic or global supply sources for key metals, then they risk supply disruption or cost increases that could slow the pace of the energy transition.

The potential for global supply constraints is not due to a lack of resources in the ground, but a mismatch between the global mining project pipeline and the speed of the energy transition. Historical trends in reserve and resource development support that there will be enough metal available to meet 2050 energy transition demands.

Shift in global imports profile

Europe’s metals import profile would need to shift in the next decade as its energy transition requirements increase. Active choices will be required, including sustainability considerations.

For example, China is the dominant global refiner of lithium, cobalt, and rare earths, and so is positioned to supply more of Europe’s growing needs without other diversification. Indonesia will provide most of the world’s planned nickel capacity expansion by 2030, largely through China-owned operations. Both regions predominantly produce their metals with coal-fired power and a high carbon footprint (although individual producers vary).

Russia’s major share in Europe’s alumina/aluminium, Class 1 nickel, and copper import markets also requires assessment. After the 2022 Ukraine invasion, there is a new pressure for Europe to find alternative supply sources. This would further limit choice in supply constrained global markets.

Lastly, Europe has anti-dumping duties in place for aluminium and silicon to safeguard against proven dumping from Chinese state-funded over capacities. Trade defence will continue to be required when there is evidence of unlawful trade practices.

Ensuring sustainability of Europe's metals supply chains

Risks of supply constraints

Europe aims that its energy transition will be supplied by sustainable materials and responsible supply chains.

The shift from a fossil fuels system to one powered by metals-intensive technologies has fundamental lifecycle benefits:

- More material efficient: The continual burning of fossil fuels is replaced by metals which last the lifetime of a product (for example, an electric car uses an estimated 8x less raw materials input overall than a conventional car)

- More circular: Metals can be indefinitely recycled due to their permanent properties, and so once mined they will be used in multiple lifecycles if effective recycling systems are in place

But the energy transition’s higher metals requirement will require that potential adverse environmental and social impacts are also addressed in the production stage.

At a global level, producing the metals in scope currently contributes to just over 3% of the world’s greenhouse gas emissions. Mining operations impact local biodiversity, create different types of waste, and have potential for local pollution. Human rights protections – including for indigenous populations – are also in focus. Each metal and region has a different ESG profile.

Major metals producers have improved their sustainability performance in the last decade. They are now required to take further action to reduce their carbon footprint in line with the Paris Agreement and to minimize other environmental impacts while benefiting their communities.

Europe has three levers to address the sustainability of its metals supply chains.

1. Recycle as much as possible, under the right conditions

By optimising its metals recycling value chains, Europe will lower its need for new primary metals supply and the associated impacts.

Replacing primary metal with secondary metal allows for CO2 savings of between 35-96%, depending on the waste stream and its complexity. Recycling also prevents the need for new mining, saving resources and avoiding the environmental im- pacts associated with extraction.

There is a need to ensure that metals recycling also takes place according to high environmental standards. Otherwise, there

is potential for pollution and health impacts in certain waste streams – for example informal electronics scrap recycling in the developing world.

2. Produce what is feasible within Europe, while driving continual improvement

Metals produced in Europe have a lower average CO2 footprint than the rest of the world, and benefit from Europe’s environmental and social protections. The EU’s evolving climate and environmental policy framework is a basis for mobilizing the sector’s continual improvement.

The EU has implemented a package of environmental policies that control impacts from its domestic mining and refining operations. Rules are in place to limit air and water emissions, to manage extractive waste, to safeguard biodiversity, and to restore mining sites post-closure. Social standards are also high.

Some Member State frameworks differ from each other, for example when it comes to mining codes. But overall, producing metal within Europe avoids the environmental and social risks that are mapped in certain other jurisdictions.

3. Import from responsible sources, with robust certification

The EU’s proposed due diligence rules will make it a legal requirement for all big European suppliers to ensure environmental and social risks are controlled in their supply chains. This is necessary to mitigate the potential for adverse impacts from Europe’s imported metals supply.

Europe has partnered with other countries, such as Canada, which already have equivalent environmental and social protections established in law. And there are individual operators across all regions who have invested into controlling their impacts and supporting communities (and those who have not).

Proven responsible operators should be favoured for Europe’s clean energy technology supply chains, in parallel to efforts for addressing the root causes of some impacts (e.g. the Fair Cobalt Alliance’s work to improve artisanal and small-scale mining conditions in the Democratic Republic of Congo).

Numerous industry certification schemes allow companies to audit their environmental and social performance. These are based on international frameworks such as the OECD Guiding Principles for Fundamental Rights and are the basis for demonstrating due diligence. Each has a different scope and comprehensiveness. Further rationalisation and strengthening is expected in the next decade.

Conclusion: Achieving Europe's goal for energy transition metals resilience

Europe’s goal of improved self-sufficiency for energy transition metals is achievable in the long-term by 2050, led by an optimisation of its recycling value chain for clean energy technologies and other metals-containing waste streams (alongside continued levels of primary supply).

In 2050, a circular Europe could have an improved self-sufficiency of between 50% and 100% for its combined primary and secondary raw materials inputs, and between 70% and 100% for its metals.

But for battery metals, rare earths and silicon, recycling will not provide meaningful supply to Europe until after 2040 when high volumes of clean energy technologies start reaching their end-of-life. This supply gap can only be filled with increased primary metals supply.

Europe’s energy transition faces supply vulnerabilities and a sufficiency deficit in the next 15 years without secure inputs. Taking forward domestic mining and refining projects would soften Europe’s medium-term supply risk, and this will also need to be combined with active import choices with environmentally responsible partners under fair trade conditions. Europe also faces a challenge to maintain its existing manufacturing capacity in a decade of potential high energy prices.